Present Value of a Structured Settlement or Annuity

You can find the present value of your structured settlement by using a formula or a present value table. The present value is the cash value of all future payments due to you minus a percentage set by the buyer. This percentage is called the discount rate, and the higher it is, the lower the value of your structured settlement payments.

- Written By Rachel Christian

Rachel Christian

Writer & Researcher

Rachel Christian is a Certified Educator in Personal Finance with FinCert, a division of the Institute for Financial Literacy. She is committed to promoting financial literacy and making complex financial topics accessible to readers from all walks of life.

Read More - Reviewed By Roger Wohlner

- Updated: May 8, 2023

- This page features 4 Cited Research Articles

The time value of money states that money received at a future date is worth less than the same amount today because the opportunity for to invest and grow the initial amount is postponed.

The buyer must make up for the opportunity cost — that is, the investments the buyer forfeits in order to buy your future payments — by discounting the full amount of the payments you are selling. Each purchasing company will set its own discount rate based on factors such as prevailing interest rates and the gains it could realize with an alternate investment.

What Is Present Value?

Very simply, the present value is the value of a dollar today taking into account the time value of money. The present value of a stream of future payments will always be less than the actual cash value of a qualified funding asset that finances the future payments from a structured settlement or an amount of cash promised for some time in the future.

Present Value Formula

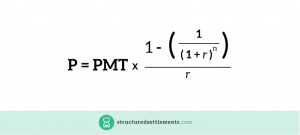

The formula for calculating present value is:

In the formula above, PMT is equal to your fixed periodic payments, r is the interest rate, and n represents the number of payments remaining.

For example, if you have a structured settlement that pays you $600 a month through an annuity with a 2 percent interest rate, and you have 12 payments outstanding (one year’s worth of payments), the present value of your remaining payments would be $7,122.60. Note that in this case, the payments occur 12 times a year, so we divide the annual interest rate by 12. Likewise, if the payments occurred quarterly, we would divide by four.

Why Is it Important for You to Know the Present Value of Your Structured Settlement?

Knowing your net worth is crucial to your personal financial planning. Your net worth is the total value of your assets after deducting any liabilities you have. If you assume any asset you own is worth more or less than it actually is, you have an inaccurate picture of your financial health.

If you want real control over your finances, you need to know the present value of your structured settlement or annuity payments.

Future Value vs. Present Value

In order to put this in context, consider that your contract has an accumulated value, which is the actual cash value you would receive over time if you collected your payments on schedule. This is also referred to as the contract’s future value.

Future value is simply the value of your structured settlement given the interest rate and the number of years you hold the annuity.

It’s extremely important to understand, however, that your structured settlement is growing tax-deferred with compound interest, so you are not paying taxes on this money right now and the funds are earning interest on the previous period’s earned interest.

Other Methods for Calculating Present Value

You can calculate present value using a structured settlement calculator or a present value table. Excel includes a function for present value that allows you to plug in the values used in the present value formula to find the dollar amount that your contract is worth today.

The key criteria to keep in mind are:

- The present value formula, as well as the calculator, present value table and Excel function, can be used only with fixed values.

- The examples on this page use the formula for an ordinary annuity, meaning that you receive your payments at the end of the period, as opposed to the beginning.

- The present value formula and the Excel function will give you the most accurate results based on the values you put in. Present value tables give rounded estimates based on a limited number of factors, and structured settlement calculators provide you with estimates based on incomplete information.

Always remember that your structured settlement was designed to protect your financial well-being and that of your dependents. If you have any reservations about selling your payments, you should speak to a qualified, trustworthy financial advisor — or an attorney who specializes in structured settlements — before you make a decision.

4 Cited Research Articles

- Averkamp, H. (n.d.). Present Value of an Ordinary Annuity. Retrieved from https://www.accountingcoach.com/present-value-of-an-ordinary-annuity/explanation/3

- Cooper, D., Franklin, M. & Graybeal, P. (2019, February 14). Principles of Accounting Volume Two: Managerial Accounting. Retrieved from https://openstax.org/books/principles-managerial-accounting/pages/11-3-explain-the-time-value-of-money-and-calculate-present-and-future-values-of-lump-sums-and-annuities

- Frick, D. (2007, November 30). Time Value of Money Concepts. Retrieved from http://www.frickcpa.com/tvom/TVOM_Annuity_Due.asp

- Internal Revenue Service. (2019, March 20). Excise Tax on Structured Settlement Factoring Transactions and Audit Technique Guide. Retrieved from https://www.irs.gov/pub/irs-mssp/structured_settlement_factoring.pdf